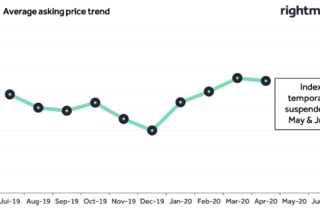

A boom in property buying activity in the aftermath of the Spring lockdown and the announcement of a Stamp Duty holiday seemed to jar with some daunting GDP numbers, in the latest market outlook. But it is likely that the market’s current energy will carry through into next year nevertheless, as transactions take time to process.

The majority of deals done since the market re-opened originated in the pre-lockdown period, suggests momentum will continue to build.

The average time between a sales instruction and an exchange is around six months.

Most exchanges in recent months were unconnected to the post-lockdown burst of activity, Almost two-thirds (65%) of UK transactions that took place in August and September were instructed for sale before the market re-opened on 13th May. And more than eight in ten (83%) exchanges originated from market valuations that were carried out before mid-May.

The number of instructions to sell only reached normal levels a fortnight after the market re-opened, the highest weekly number of instructions in September. Unless deals start to fall through at an unusually high rate, it suggests strong levels of transactional activity for the rest of 2020.

The end of the Stamp Duty Holiday in March 2021 will only add to a continued flurry of buying activity in the opening quarter of the new year.

A second national lockdown could suspend the market again, putting the record number of offers accepted over the summer on ice.

Will there be positive news on a treatment or a vaccine before the momentum runs out?